| For a lot of our clients running their business is the first time they have had to look at any annual accounts or financial statements and so it can be a bit bewildering when we send you the accounts to sign off each year. When we send them through to you, it’s important to review them thoroughly to gain insights into your business’s performance and ensure you are happy to sign and file the accounts. Always feel free to ask us any questions about reports we send over to you and we are always happy to help. The key things to look at are: |

| Balance Sheet Assets Assets are everything that the business owns or is owed by someone. Examine the value of your assets (things you own), including current assets (e.g., cash, accounts receivable) and non-current assets (e.g., property, computer equipment, furniture). There may be prepayments in here that your accountant has added in, these are things that you have paid for in advance of using them. Often this will be insurance policies that can be paid for for the year, but the policy may not align with your business year. Liabillities Liabilities are anything that the company owes to someone else, things like bank loans and taxes fall into this section. Review your company’s obligations (amounts the business owes), such as short-term liabilities (e.g., accounts payable) and long-term liabilities (e.g., loans). Another accounting adjustment here may be for accruals, this is money the company owes but hasn’t been invoiced yet. Accounting fees for the year end accounts will often by accrued. Equity Understand the owner’s equity, which represents the residual interest in the assets of the entity after deducting liabilities. This is share capital, retained earnings, drawings etc. For most small limited companies the equity will be the share capital, plus the retained profit (or losses) since the company started, less any dividends taken from the company. To be able to pay dividends out of the company this needs to be a positive balance. |

|

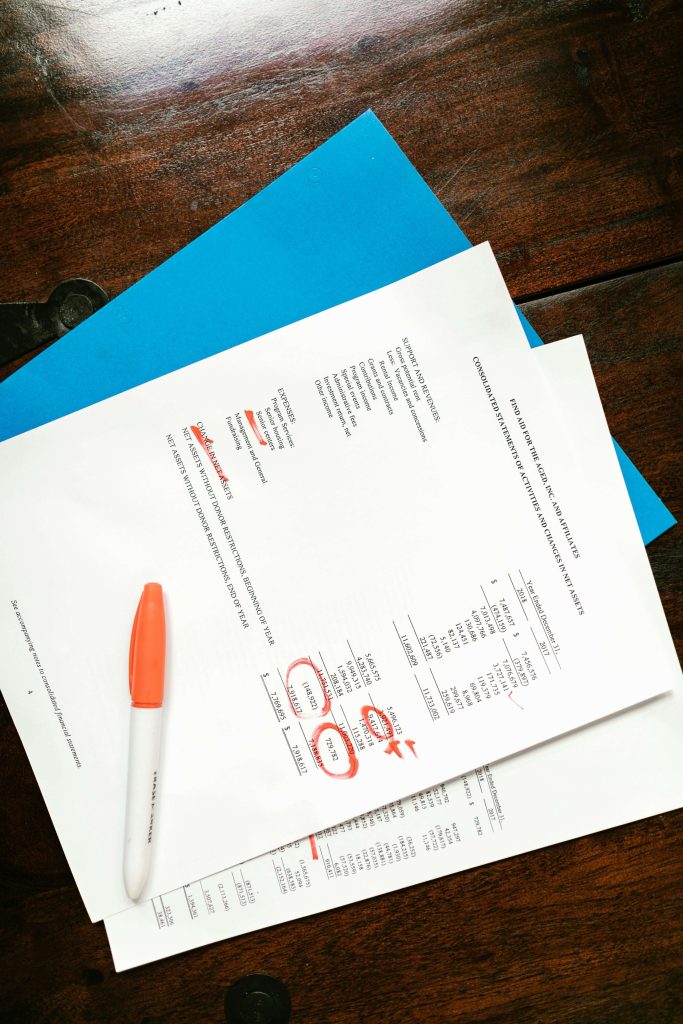

| Income Statement (Profit and Loss) Revenue Look at the total income generated by your business. Is this in line with what you expected to see? Expenses Review the various expenses, including operating expenses, cost of goods sold (COGS), and other costs. Is there anything in there that looks very high or is there something missing that you expected to see? There are often expenses that we add as part of the year end process like directors salary and use of home. Profit or loss Determine whether your business made a profit or incurred a loss during the period. Is the number at the bottom of the profit and loss a positive or negative? Tax implications Make sure that you are setting aside money to pay the tax man! ideally throughout the year but definitely when you have the final numbers in front of you. Your profit will be the main driver of the amount of tax you need to pay so make sure you have included everything and told your accountant all they need to know to calculate the tax number. Compare and review the statements Compare to previous periods Compare the current financial statements with those from previous periods to identify trends and changes. Look for improvements or declines. Have you made more revenue this year? have your costs increased? Make sure that you understand the changes in your business and whether they are going the way that you want them to. Budget vs. Actuals If you had a budget make sure you review the final numbers against what you had budgeted. Again make sure you identify any big changes and that you understand the reasons behind them. |

| Ask Questions!!!!! If you have any uncertainties or questions about financial statements, don’t hesitate to ask us. If when you are looking at the accounts the results are very different to what you expected to see then just ask and we can review everything together again. Maybe you just do not understand at all what you are seeing, then get in touch and we can help before you sign everything off! When looking at the year end accounts it is a great chance to review how things are going, what you want to achieve and see where things can be improved! But you need to understand what you are looking at to make the most of them. |